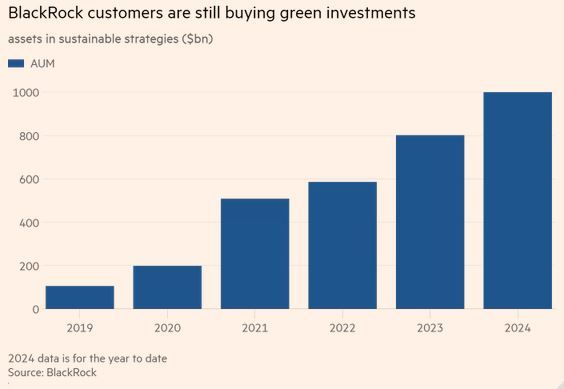

BlackRock’s sustainable investments now over $1 trillion

Here’s a note from Nawar Alsaadi:

BlackRock has pulled back on talking about sustainable investing and reduced its support for ESG resolutions, but this hasn’t stopped money flows into BlackRock sustainable strategies, which have exceeded $1 trillion in assets this year (chart above). As a matter of fact, the growth rate in money flows for BlackRock sustainable strategies is on par with last year and is the fastest growth since 2019 (except for 19/20). These numbers put in context the issue of the anti-ESG backlash, and to what extend sustainable investment strategies have become core to the business models of asset managers.

As to why money is flowing into such strategies, for starters, according to Morgan Stanley, over the past five years, sustainable funds have achieved a median performance of 4.7% more than traditional funds with outperformance accelerating since December 2022. 54% of individual investors plan to increase their allocation to sustainable investment strategies. Meanwhile, the percentage of asset owners allocating over 50% of their investments to strategies with ESG considerations has increased from 29% in 2022 to 35% in 2024.

Despite these large numbers, 5, 10 and 15 years from now, these numbers will be much larger. This is because the sustainable transition is an existential inevitability. 80% of the people globally want stronger climate action. And global sustainability laws, policies, and regulations continue to grow unabated. The combination of growing sustainability policy and regulations along with strong societal support are fundamentally changing the way companies do business.

And make no mistake about it, a sustainable world will have winners and losers. Those holding to the past will increasingly see their relevance and market share erode, while those looking to the future will increasingly gain clout and relevance.

BlackRock may wobble when it comes to their ESG/sustainable investing communications and ESG engagements, but if these blue bars are any indication, BlackRock is carving out its place in the sustainable world to come. Are you doing the same?