The missing “ESG to financials translation” matrix

Here is a note from Nawar Alsaadi:

Corporate ESG solution providers need to develop better ESG-to-financials translation matrices. Most the corporate ESG solution providers I’ve assessed are in the “bean counting business” but what we need is tools to measure the beans’ nutritional quality. What I mean by that is tools that can link soil quality, ambient temperature and light intensity among other growing factors to a given bean nutritional quality.

In a business context, the above means tools to understand the short and long term financial implications of a wide range of sustainability related initiatives and activities, and not just their resulting non-financial output.

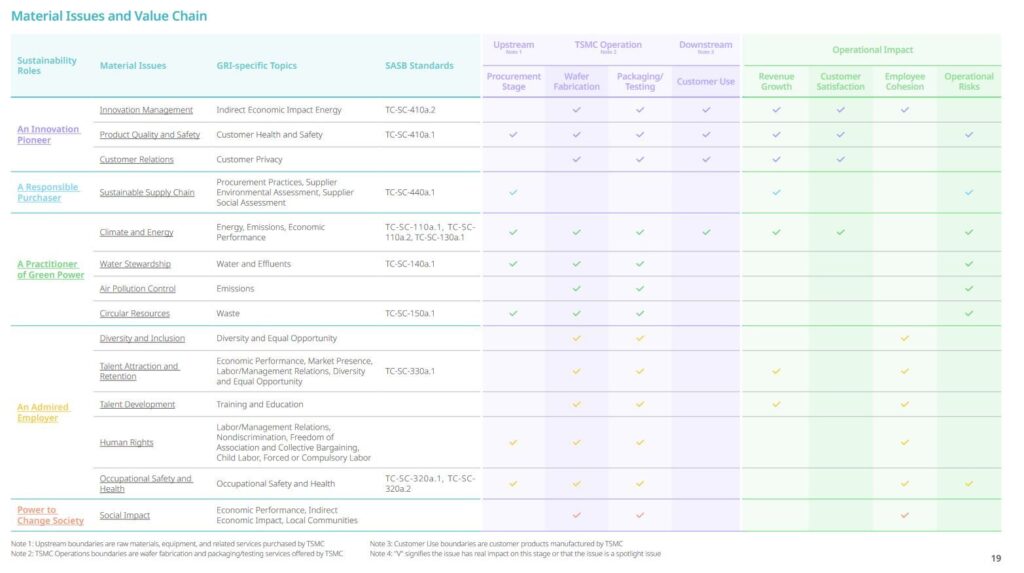

Attached is a table from TMSC 2022 sustainability report linking key ESG metrics to the value chain and to operational impacts. It’s a useful table, however, it lacks an impact delta. Meaning, what this table doesn’t provide is to what extent talent development impact revenue growth? To what extent water stewardship impacts operational cost? The TSMC table tells half the story, the other half is a product begging to be built.

Elucidating these relationships is possible with access to the following information:

➡ Internal financial and operational data (inclusive of value chain dependencies and operational ESG metrics).

➡ Relevant external factors (such as price of carbon, price of water, regulatory requirements … etc.).

➡ Empirical research on the relationships between qualitative and quantitative non-financial factors and business performance.ESG corporate solution providers need to design tools that go beyond data capture and think about tools than help with connecting the dots between financial and non-financial metrics. For example, next to each ESG data line item, a dropdown link can be provided showing relevant research on the relationship between that metric and financial performance.

Such functionality can help CSOs make the case as to why investing in sustainability matters from a business standpoint. In time, these relationships can be incorporated in the code, thus giving decision makers the ability to experiment with and model different sustainability-related business scenarios.